Navigating the intricacies of real estate transactions can be a daunting task, especially when it comes to safeguarding your property rights. Title insurance offers a crucial layer of protection against potential ownership disputes, ensuring peace of mind and financial security. In this comprehensive guide, we will delve into the intricacies of title insurance in Illinois, empowering you with the knowledge to make informed decisions.As a homeowner in Illinois, understanding the costs associated with title insurance is paramount. This guide will meticulously dissect the factors that influence title insurance premiums, providing you with a clear understanding of what drives these expenses. By examining coverage extent, property value, and lender requirements, you will gain invaluable insights into the pricing structure of title insurance policies.Furthermore, we will navigate the complexities of title insurance policies in Illinois, unraveling their intricate terms and conditions. This exploration will equip you with the ability to discern the nuances of coverage and make choices that align with your specific needs. Exploring the value of title protection, we will delve into the potential risks and liabilities associated with property ownership.To further enhance your understanding, we will provide a step-by-step guide to title insurance in Illinois, demystifying the process and empowering you to safeguard your real estate investment effectively. This comprehensive introduction sets the stage for an in-depth exploration of title insurance in Illinois, arming you with the knowledge to make informed decisions and protect your property rights.

Deciphering the Costs of Title Protection in Illinois

Deciphering the costs of title protection in Illinois can be a daunting task, but understanding the factors that influence title insurance premiums is crucial for making informed decisions. The extent of coverage and type of policy you choose, the property’s value and location, lender requirements, and loan amount all play significant roles in determining the cost. By delving into these factors, you can navigate the complexities of title insurance in Illinois and ensure that you’re adequately protected while minimizing unnecessary expenses.

Factors Determining Title Insurance Premiums in Illinois

Deciphering the intricacies of title insurance premiums in Illinois can be a daunting task. Several factors intertwine to determine the cost of safeguarding your property rights, each playing a pivotal role in shaping the final premium you’ll pay. Understanding these variables will empower you to make informed decisions and navigate the title insurance landscape with confidence. Just as a skilled chef carefully balances ingredients to create a delectable dish, title insurance companies meticulously consider various elements to calculate your premium, ensuring you receive the optimal coverage for your unique situation.

Coverage Extent and Policy Type

Factors Determining Title Insurance Premiums in Illinois

When it comes to title insurance in Illinois, understanding the factors that influence its cost is crucial. The extent of coverage you select and the type of policy you opt for, along with your property’s value and location, all play a role in determining your premium. Don’t forget the impact of lender requirements and the loan amount you secure. These factors, like ingredients in a recipe, combine to shape the price you’ll pay for safeguarding your real estate investment. By delving into these details, you’ll gain a deeper grasp of how much title insurance will set you back in Illinois.

Property Value and Location

When it comes to the cost of title insurance in Illinois, several key factors come into play. The extent of coverage you opt for and the type of policy you choose can significantly impact the premium. High-value properties and those located in areas with a history of title issues tend to command higher premiums. Additionally, lender requirements and the loan amount can also influence the cost. Lenders often require title insurance to protect their financial interest in the property, and the higher the loan amount, the greater the potential risk for the lender, which can lead to a higher premium. Understanding these factors will help you make informed decisions when selecting a title insurance policy that meets your specific needs and budget.

Lender Requirements and Loan Amount

Determining the cost of title insurance in Illinois involves considering various factors that shape your policy’s premium. The coverage extent you select, whether a standard or enhanced policy, directly impacts the cost. Naturally, properties with higher values in prime locations typically attract higher premiums. Furthermore, if you’re securing a loan, your lender may require a more comprehensive policy, which can affect the cost. Understanding these factors empowers you to make informed decisions about your title insurance coverage, ensuring you get the protection you need without overpaying.

Navigating the Fine Print: Understanding Title Insurance Policies in Illinois

As you delve into the labyrinthine world of real estate, understanding the intricacies of title insurance is paramount. In Illinois, navigating the fine print of these policies is no easy feat. But fear not, for we’re here to illuminate the complexities and empower you with knowledge. Title insurance is your safety net, safeguarding you from potential financial pitfalls stemming from title defects. It’s like having a trusty guide by your side, alerting you to hidden obstacles that could derail your homeownership journey. So, let’s dive into the fine print together, demystify the legalese, and ensure you’re fully protected in the Land of Lincoln.

Breaking Down the Process: A Step-by-Step Guide to Title Insurance in Illinois

Are you preparing to embark on your homeownership journey in the Land of Lincoln? Title insurance is a crucial investment safeguarding your property rights and financial well-being. This comprehensive guide will take you on a step-by-step journey through the title insurance landscape in Illinois, answering the burning question: “How much is title insurance in Illinois?” We’ll delve into key factors influencing premiums, ensuring you make informed decisions to protect your valuable investment.

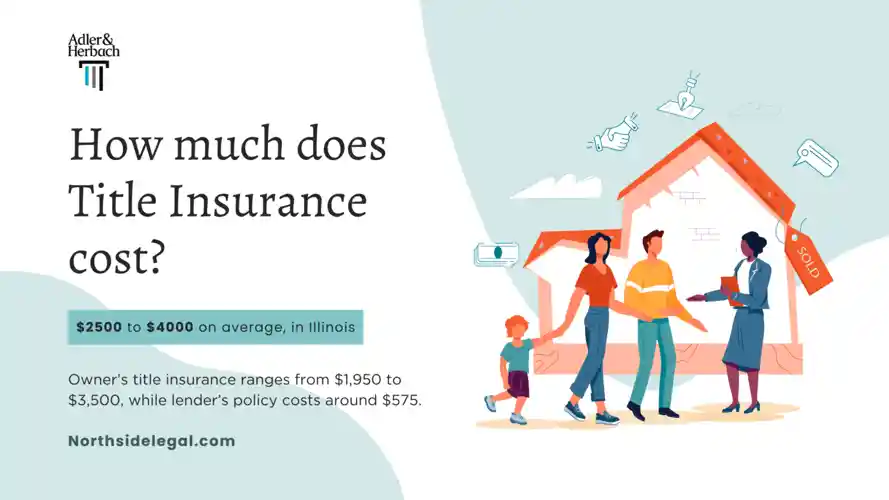

Q1. What is the average cost of title insurance in Illinois?

Ans: The average cost of title insurance in Illinois is between $1,000 and $2,000.

Q2. What factors affect the cost of title insurance in Illinois?

Ans: The cost of title insurance in Illinois is affected by the purchase price of the property, the amount of coverage you need, and the company you choose.

Q3. Is title insurance required in Illinois?

Ans: Title insurance is not required by law in Illinois. However, lenders typically require it to protect their investment.

Q4. What does title insurance cover in Illinois?

Ans: Title insurance protects you from financial loss if there is a defect in the title to your property.

Q5. How long does title insurance last in Illinois?

Ans: Title insurance lasts for as long as you own the property.

Q6. Can I get a discount on title insurance in Illinois?

Ans: You may be able to get a discount on title insurance in Illinois if you have a good credit score or if you are a member of certain organizations.