As a small business owner, you undoubtedly recognize the importance of safeguarding your enterprise and employees. One indispensable element of this protection is workers’ compensation insurance. This comprehensive guide will empower you with the knowledge and insights necessary to navigate the complexities of workers’ compensation insurance, ensuring compliance, mitigating risks, and providing financial protection for your business and employees. Understanding the intricacies of workers’ compensation insurance is crucial for safeguarding your small business. I will delve into the essential aspects of this insurance, empowering you with the knowledge to make informed decisions and navigate the complexities of the system. Together, we will explore the eligibility requirements, coverage options, and the step-by-step process of obtaining workers’ compensation insurance. Furthermore, I will guide you through the practicalities of managing workers’ compensation claims, ensuring compliance, and mitigating potential risks. By providing a comprehensive overview of the workers’ compensation insurance system, I aim to equip you with the tools and knowledge to protect your business and employees effectively. Let us embark on this journey together, ensuring the well-being of your employees and the stability of your small business.

The Ultimate Guide for Small Businesses: Navigating the Complexities of Workers’ Compensation Insurance

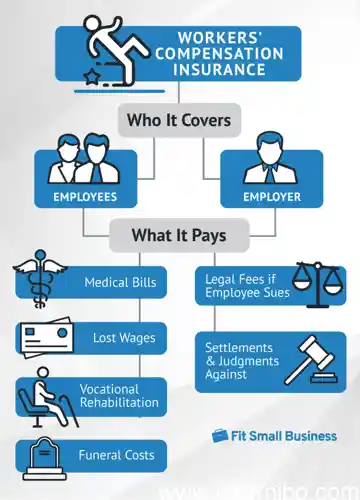

Navigating the intricacies of workers’ compensation insurance can be a daunting task for small business owners, but it’s a crucial step in safeguarding your business and employees. Just like securing your home with insurance, workers’ compensation insurance protects your business from the financial consequences of workplace accidents or illnesses. It provides coverage for medical expenses, lost wages, and other benefits to injured employees, ensuring their well-being and reducing your liability as an employer. By understanding the complexities of workers’ compensation insurance, you can make informed decisions that protect your business and foster a safe and secure work environment for your employees.

Unlocking Financial Protection: Why Workers’ Compensation Insurance is Indispensable for Small Business Owners

In the realm of small business ownership, protecting your employees and safeguarding your financial well-being are paramount. Workers’ compensation insurance serves as a crucial shield against the unforeseen, ensuring that you’re equipped to navigate the complexities of workplace injuries or illnesses. This comprehensive guide will illuminate the intricacies of workers’ compensation insurance, empowering you to make informed decisions and unlock the financial protection your business deserves. Embark on this journey with us, and let’s unravel the complexities of workers’ compensation together, ensuring your business thrives in the face of adversity.

Empowering Employers: A Comprehensive Overview of the Workers’ Compensation Insurance System

As a small business owner, you’re responsible for protecting your employees and your business. Workers’ compensation insurance is a critical part of that protection. It provides financial support to employees who are injured or become ill on the job, and it can help protect you from lawsuits. In this comprehensive guide, we’ll walk you through everything you need to know about workers’ compensation insurance for small businesses, from eligibility and coverage requirements to finding the best insurance options and managing claims. By understanding the ins and outs of workers’ compensation insurance, you can ensure that your employees are protected and your business is safeguarded.

Step-by-Step Guide: Demystifying the Process of Obtaining Workers’ Compensation Insurance

Journey into the world of workers’ compensation insurance, a vital safeguard for small businesses. Obtaining this coverage is like securing a financial fortress against the unexpected. It’s like having a safety net that catches you when life throws curveballs. Navigating the process may seem daunting, but we’ve got you covered with this step-by-step guide that will empower you to make informed decisions and protect your business from costly surprises.

Determining Eligibility and Coverage Requirements

Navigating the intricacies of workers’ compensation insurance can be a daunting task for small business owners, like navigating a labyrinth without a map. However, understanding the process of obtaining this crucial protection is paramount to safeguarding your business and employees. By following a step-by-step approach, you can simplify the journey, ensuring compliance and minimizing risks that could derail your operations. Let’s embark on this demystifying journey together, empowering you to secure the financial protection your business needs to thrive.

Navigating Insurance Options and Finding the Best Fit

Navigating the complexities of obtaining workers’ compensation insurance can be a daunting task, especially for small businesses with limited resources and expertise. But don’t let the complexities deter you from providing essential protection to your employees and safeguarding your business. By breaking down the process into manageable steps, you can demystify the process and ensure compliance. We’ll walk you through the eligibility requirements, guide you through the insurance options available, and help you choose the best policy that aligns with your specific needs and budget. Remember, securing workers’ compensation insurance is not just a legal obligation but also a wise investment in your business’s well-being.

Ensuring Compliance and Mitigating Risks: A Practical Guide to Managing Workers’ Compensation Claims

Navigating workers’ compensation claims can be a daunting task, especially for small business owners who may lack the resources and expertise. This comprehensive guide will provide you with a practical understanding of how to ensure compliance and effectively manage claims. By demystifying the process, you can empower yourself to protect your business and employees while mitigating potential risks. With clear explanations and step-by-step guidance, this guide will help you stay informed and confident in handling workers’ compensation claims.

Q1. What are the benefits of workers’ comp insurance for small businesses?

Ans: Protects businesses from financial liability in case of employee injuries or illnesses.

Q2. How much does workers’ comp insurance cost?

Ans: Premiums vary based on factors such as industry, payroll, and location.

Q3. What are the requirements for obtaining workers’ comp insurance?

Ans: Most states require businesses with employees to carry workers’ comp insurance.

Q4. How can small businesses get affordable workers’ comp insurance?

Ans: Shop around for quotes from multiple providers, consider group policies, and implement safety programs.

Q5. What are the penalties for not having workers’ comp insurance?

Ans: Fines, legal action, and personal liability for business owners.

Q6. How can I determine the right coverage amount for my business?

Ans: Consult an insurance agent to assess your risks and determine appropriate coverage limits.