Soaring car insurance premiums can be a major financial burden, especially when they reach the staggering amount of $500 a month. This exorbitant cost can leave you feeling frustrated, confused, and wondering how you can possibly afford to keep your car on the road. If you’re in this situation, don’t despair. Understanding the contributing factors to your high premiums and exploring potential solutions can help you navigate this financial maze and find relief.Together, we’ll embark on a comprehensive journey to uncover the reasons behind your high insurance costs. We’ll examine the impact of various factors, including your age, driving history, and vehicle type. We’ll also explore the role of insurance providers and uncover hidden discounts and savings that can significantly reduce your premiums.Furthermore, we’ll delve into alternative insurance options that may offer more affordable solutions. From usage-based insurance to state-specific programs, we’ll leave no stone unturned in our quest to find ways to lower your car insurance costs.Throughout this exploration, we’ll provide clear explanations, practical tips, and real-world examples to guide you every step of the way. Our goal is to empower you with the knowledge and tools you need to negotiate effectively with insurance companies, optimize your insurance coverage, and ultimately achieve significant savings on your car insurance premiums.

What Factors Are Driving My Car Insurance Premiums to $500?

Have you been baffled by your car insurance premiums skyrocketing to an eye-watering $500 a month? You’re certainly not alone. This hefty sum can put a significant dent in your budget, leaving you scratching your head and wondering what’s behind this financial drain. The reasons for such exorbitant premiums can be multifaceted, ranging from factors within your control to those beyond your immediate influence. Understanding these contributing factors is crucial to devising a strategy for lowering your insurance costs and reclaiming control over your finances. In this article, we’ll delve into the intricate web of elements that can drive your car insurance premiums to such a steep figure, empowering you with the knowledge to make informed decisions and potentially save a substantial amount on your insurance expenses.

How to Uncover Hidden Discounts and Savings on Car Insurance

Wondering why your car insurance premiums have skyrocketed to $500 a month? You’re not alone. Many factors contribute to high insurance costs, but there are also ways to uncover hidden discounts and savings that can significantly reduce your monthly payments. By addressing factors such as your age, driving history, and vehicle type, you can gain a better understanding of how these elements influence your premiums. Additionally, exploring alternative insurance options like usage-based insurance or state-specific programs can provide you with cost-effective solutions. Remember, you have the power to negotiate with insurance providers and find ways to lower your premiums. Let’s dive into the details and uncover the secrets to unlocking affordable car insurance.

Examining the Impact of Age, Driving History, and Vehicle Type on Insurance Costs

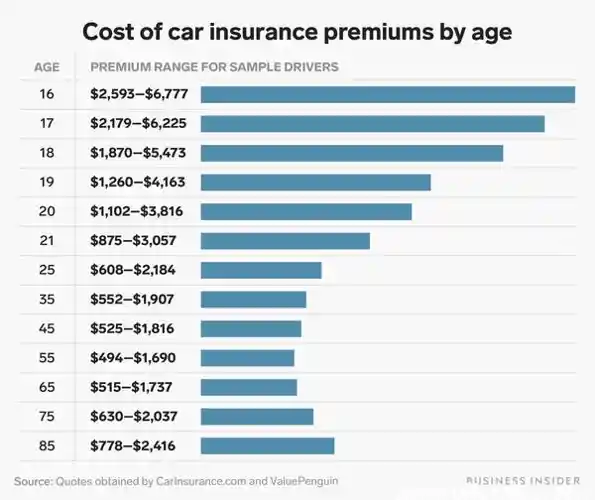

When it comes to car insurance, understanding the factors driving up your premiums is crucial. Age, driving history, and vehicle type all play a significant role in determining your rates. As you age and gain more driving experience, your risk profile generally improves, leading to lower premiums. However, a blemished driving record with accidents or violations can offset this benefit. Similarly, certain vehicle types, such as sports cars or luxury models, are statistically more likely to be involved in accidents, resulting in higher insurance costs. If you’re looking to save on car insurance, it’s worth examining these factors and considering ways to mitigate their impact on your premiums.

Understanding How Age and Experience Influence Premiums

The significant factors shaping your car insurance premiums to reach a staggering $500 per month can be a perplexing puzzle. Age plays a role, as young drivers are considered riskier and attract higher premiums. Similarly, a checkered driving history marked by accidents or violations weighs heavily, leading to inflated costs. Additionally, the type of vehicle you drive influences insurance rates; luxury or sports cars often demand higher premiums. Understanding these factors is crucial for uncovering potential discounts and savings on your car insurance policy.

Exploring the Role of Driving Record and Violations

When it comes to why your car insurance premium has skyrocketed to $500, the suspects are numerous, but the most common culprits are age, driving history, and vehicle type. Age plays a crucial role, with younger drivers facing higher premiums due to their limited experience and higher risk of accidents. It’s not just about age, though; a checkered driving record, even for older drivers, can significantly inflate premiums. Speeding tickets, accidents, and DUIs are like red flags to insurance companies, signaling a higher likelihood of future claims. And then there’s your ride. Insuring a flashy sports car or a luxurious SUV will cost you more than a modest sedan. These vehicles attract higher premiums due to their expensive repair costs and increased risk of theft. Understanding these factors can help you unravel the mystery behind your soaring car insurance bills.

Negotiating with Insurance Providers to Reduce High Premiums

If your car insurance premiums have skyrocketed to $500 a month, it’s time to take action. Understanding why your rates are so high is the first step towards lowering them. Factors like your age, driving history, and the type of vehicle you drive all play a role. But don’t despair, there are ways to negotiate with your insurance provider to reduce those high premiums. By uncovering hidden discounts and savings, you can bring down the cost of your coverage without sacrificing the protection you need. So, let’s delve into the factors influencing your premiums and explore strategies to save money on your car insurance.

Alternative Options for Affordable Car Insurance

If you’re wondering why your car insurance premiums have skyrocketed to $500 a month, it’s time to explore alternative options. You shouldn’t have to break the bank to maintain coverage, especially when there are affordable choices available. Let’s uncover hidden discounts, negotiate with providers, and consider alternative insurance plans to help you save money and keep your car protected without sacrificing your financial well-being.

Considering Usage-Based Insurance for Lower Premiums

If you’re wondering why your car insurance premiums have skyrocketed to $500 a month, you’re not alone. Many factors can contribute to such high costs, such as your age, driving history, and vehicle type. Insurance companies assess risk based on these factors, and if you fall into a higher-risk category, you’ll pay more for coverage. But don’t despair! There are alternative options available to help you find affordable car insurance. Usage-based insurance, for instance, can lower your premiums by tracking your driving habits and rewarding you for safe practices. Additionally, exploring state-specific programs and high-risk pools can provide more cost-effective options for those who need them most. By considering these alternatives, you can save money on your car insurance while still maintaining adequate coverage.

Exploring State-Specific Programs and High-Risk Pools

Is your car insurance premium bleeding you dry, leaving you wondering if there’s a more affordable option out there? You’re not alone. Many drivers find themselves in the same boat, feeling the pinch of sky-high insurance costs. But don’t panic—there are alternative options that can help you save big. We’ll explore usage-based insurance, where you only pay for the miles you drive, and state-specific low-cost programs designed to assist drivers with limited means. We’ll also take a closer look at high-risk pools, a lifeline for drivers with checkered pasts. By venturing beyond the traditional insurance landscape, you can unearth hidden discounts, reduce your premiums, and secure a more affordable path to protecting your ride.

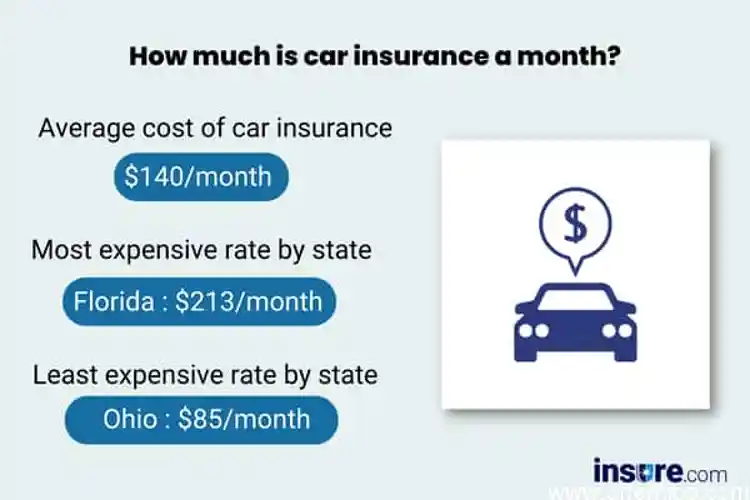

Q1. Why is my car insurance 500 a month?

Ans: Your car insurance may be $500 a month due to factors like your age, driving record, location, and type of vehicle.

Q2. Is it normal for car insurance to be 500 a month?

Ans: While $500 a month can be higher than average, it can be normal depending on your circumstances.

Q3. How can I lower my car insurance that is 500 a month?

Ans: Consider raising your deductible, comparing quotes from different insurers, and taking advantage of discounts.

Q4. What factors contribute to high car insurance rates?

Ans: Age, driving violations, location, and the value of your vehicle can all impact your insurance premiums.

Q5. Is there a way to get cheaper car insurance if I’m under 25?

Ans: Options like adding a parent to your policy or taking a defensive driving course may help lower your rates.

Q6. Can I get discounts on my car insurance to reduce the $500 monthly cost?

Ans: Yes, discounts for things like bundling policies, having a good driving record, and installing safety features can save you money.