In the dynamic landscape of modern business, especially for small businesses, securing comprehensive commercial insurance is paramount. Commercial insurance acts as a financial safety net, protecting your business from unexpected events, liabilities, and risks that can potentially cripple operations and jeopardize your financial stability. By understanding the fundamentals of commercial insurance for small businesses, you can tailor your coverage to align with specific business needs, ensuring that your assets, employees, and reputation are safeguarded against unforeseen circumstances.Embarking on this journey of understanding commercial insurance, we will delve into the intricacies of each policy, unraveling the benefits of tailored coverage. We will explore cost-effective measures to minimize financial risks, empowering you to make informed decisions. Together, we will navigate the maze of commercial insurance options, ensuring that your business is equipped to weather any storm, thrive in the face of challenges, and achieve long-term success.

Economical Protection: Understanding Commercial Insurance for Small Businesses

If you’re a small business owner, having the proper commercial insurance coverage is crucial to protect your business from financial risks. Commercial insurance acts as a safety net, safeguarding your assets, income, and reputation. It provides peace of mind, allowing you to focus on growing your business without worrying about potential disasters or liabilities. By understanding the different types of commercial insurance available, you can tailor a policy that meets your specific needs and ensures your business is well-protected.

Why is commercial insurance crucial for small businesses?

Commercial insurance is not just a luxury for small businesses; it’s a necessity. Without it, you’re exposing your business to a wide range of risks that could potentially cripple your operations or even force you to close your doors. Just imagine if a fire destroyed your business premises or a lawsuit was filed against you, leaving you with substantial financial liabilities. Commercial insurance can provide a safety net, protecting you from these unforeseen events and helping you to weather the storms that may come your way.

Benefits of tailored insurance coverage for specific business needs

Commercial insurance is your trusty sidekick, providing a financial safety net for your small business. It safeguards your assets, shields you from potential liabilities, and keeps your operations up and running smoothly even during unexpected events.

Think of it as a superhero cape, protecting you from the unpredictable storms of business. With tailored coverage, you can customize your insurance policy to match your unique risks and needs. This means you only pay for what you need, ensuring cost-effective protection without sacrificing coverage.

Cost-effective measures to minimize financial risks

Commercial insurance serves as a financial safety net for small businesses, safeguarding them against unforeseen events that could potentially cripple their operations or finances. Just like how a sturdy umbrella protects you from the downpour, commercial insurance shields your business from the storms of liability, property damage, and business interruptions. Tailored to your specific needs, this insurance coverage empowers you to minimize risks, ensuring your business remains resilient and financially stable. By investing in comprehensive commercial insurance, you’re not merely protecting your assets but also safeguarding your dreams and aspirations for your small business.

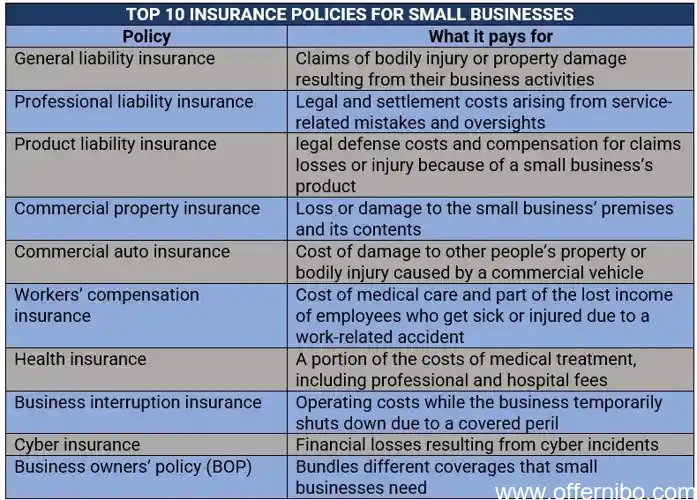

Essential Insurance Policies for Small Businesses: A Comprehensive Guide

As a small business owner, you’ve poured your heart and soul into your enterprise. But what if an unexpected event strikes, threatening to derail your dreams? Commercial insurance acts as a financial lifeline, safeguarding your business from unforeseen challenges. It’s a wise investment that can protect your assets, employees, and reputation. Small business insurance is not a one-size-fits-all solution. Tailoring your coverage to your specific needs is crucial for ensuring comprehensive protection. The first step is to identify your potential risks and vulnerabilities. From there, you can explore various insurance policies tailored to address your unique challenges. The right insurance plan can provide peace of mind, allowing you to focus on growing your business without the burden of financial worries.

General liability insurance: Shielding against common liabilities

When you’re a small business owner, you’re faced with a myriad of risks that can threaten your financial stability and growth. From potential lawsuits to property damage to lost income, it’s crucial to have the right insurance policies in place to protect your business from unforeseen events. This comprehensive guide will provide you with an in-depth understanding of the essential insurance policies for small businesses, ensuring you have the coverage you need to navigate the challenges of running a business with confidence and peace of mind.

Property insurance: Safeguarding assets and investments

Essential Insurance Policies for Small Businesses: A Comprehensive Guide

As a small business owner, protecting your assets and minimizing financial risks is crucial. There’s a wide range of commercial insurance options available, but three essential policies every small business should consider are general liability, property, and business interruption insurance.

General liability insurance shields your business against legal claims arising from bodily injury, property damage, or other incidents related to your operations. It provides peace of mind, ensuring that unforeseen events won’t jeopardize your financial stability.

Property insurance safeguards your physical assets, including your building, equipment, and inventory. Whether a fire, theft, or natural disaster strikes, this coverage helps you recover and rebuild, minimizing the potential impact on your business.

Business interruption insurance protects your income stream during unexpected events that force you to temporarily close or reduce operations. Whether it’s a natural disaster, a burst pipe, or a supply chain disruption, this coverage ensures that your business can weather the storm and continue operating without significant financial loss.

Business interruption insurance: Mitigating income loss during unforeseen events

As a small business owner, you know that unexpected events can strike at any time, threatening your financial well-being and potentially even the survival of your enterprise. That’s where commercial insurance comes to the rescue, providing a safety net to protect your assets, income, and reputation.

One of the best ways to safeguard your small business is by securing a comprehensive insurance policy that addresses your specific needs. This will typically include general liability insurance, which protects you from claims of bodily injury or property damage caused by your business operations. Property insurance is also crucial, covering your physical assets such as buildings, equipment, and inventory in the event of a fire, theft, or natural disaster.

Business interruption insurance is another valuable policy to consider. It provides coverage for lost income and expenses if your business is forced to close temporarily due to an unforeseen event such as a fire, natural disaster, or power outage. Having these essential insurance policies in place gives you peace of mind, knowing that you’re financially protected against a wide range of risks.

Navigating the Maze of Commercial Insurance Options: A Step-by-Step Approach

Navigating the maze of commercial insurance options can be overwhelming for small businesses. With various policies and insurers to consider, finding the right coverage at the right price can feel like wandering through a labyrinth. To simplify this process, take a step-by-step approach that empowers you to make informed decisions. Begin by assessing your risks and vulnerabilities. What potential threats could impact your business, from property damage to lawsuits? Identify these hazards to determine the types of coverage you need. Next, compare quotes from different insurers. Don’t just focus on the lowest price; consider the insurer’s reputation, financial stability, and customer service. Finally, carefully review the policy terms and conditions. Understand what’s covered, what’s excluded, and the limits of coverage. By following this step-by-step approach, you can navigate the maze of commercial insurance options with confidence and secure the protection your small business needs to thrive.

Determining coverage needs: Assessing risks and vulnerabilities

Navigating the maze of commercial insurance options can be a daunting task for small business owners. But with a step-by-step approach, you can find the right coverage to protect your business against financial risks.

First, assess your risks and vulnerabilities. Consider the potential liabilities your business faces, such as customer injuries, property damage, or employee lawsuits. Determine the level of coverage you need to adequately protect your assets and operations.

Next, compare quotes from different insurers. Don’t just focus on the price; consider the insurer’s reputation, financial stability, and customer service. Read the policy terms and conditions carefully to make sure you understand what’s covered and what’s not.

Choosing the right commercial insurance is like building a safety net for your business. It provides peace of mind, knowing that you’re protected against unexpected events. It’s an investment in your company’s future, ensuring that you can continue to operate and grow with confidence.

Comparing quotes and selecting the right insurer

Navigating the maze of commercial insurance options can feel like a daunting task. To simplify this process, we’ve outlined a step-by-step approach to help you understand your coverage needs, compare quotes, and choose the right insurer. By assessing your business’s unique risks and vulnerabilities, you can determine the specific coverage you require. Comparing quotes from multiple insurers allows you to find the most comprehensive coverage at a competitive price. Finally, thoroughly reviewing policy terms and conditions ensures clarity and protection, empowering you to confidently select the insurance that best safeguards your small business and sets you on the path to success.

Understanding policy terms and conditions: Ensuring clarity and protection

Navigating the world of commercial insurance can feel like venturing into a complex labyrinth, but with a step-by-step approach, you can find the right path to protect your small business. Begin by identifying your specific risks and vulnerabilities. What are your chances of facing lawsuits, property damage, or business interruptions? Understanding these potential hazards will help you determine the coverage you need. Next, compare quotes from multiple insurers. Remember, price isn’t the only factor; consider the insurer’s reputation, financial stability, and customer service. Finally, before signing on the dotted line, read and comprehend the policy terms and conditions thoroughly. It’s crucial to ensure clarity and protection, so if anything is unclear, don’t hesitate to ask your insurer for an explanation.

Beyond the Basics: Additional Considerations for Small Business Insurance

Beyond the Basics: Additional Considerations for Small Business Insurance

As your business flourishes, you may encounter unforeseen circumstances that lie outside the scope of your basic insurance policies. That’s where additional coverage comes into play. Cyber liability insurance safeguards your digital assets from malicious attacks, protecting you from financial losses and reputational damage. Employment practices liability insurance shields you against claims related to employee discrimination, wrongful termination, or harassment, ensuring a harmonious work environment. Finally, professional liability insurance provides a safety net for professionals who offer advice or services, protecting you from claims of negligence or errors in judgment. These additional layers of protection give you peace of mind, knowing that your business is well-equipped to navigate the complexities of the modern business landscape.

Cyber liability insurance: Protecting against digital threats

While general insurance policies form the foundation of your protection, additional considerations can further safeguard your small business. Cyber liability insurance shields you from the growing threats of data breaches and cyberattacks. Employment practices liability insurance safeguards you against claims related to discrimination, harassment, or wrongful termination. Professional liability insurance, also known as errors and omissions insurance, protects you from claims of negligence or errors in your professional services. These specialized policies provide peace of mind, knowing that you’re covered against a wider range of potential risks. They empower you to focus on growing your business with confidence, knowing that you have a safety net in place.

Employment practices liability insurance: Managing employee-related risks

Beyond the basics, additional insurance policies can bolster your small business’s protection. Cyber liability insurance safeguards you from digital threats, such as data breaches and ransomware attacks, that can cripple your operations. Employment practices liability insurance shields you against employee-related claims, ensuring you can manage your team with confidence. Professional liability insurance protects you from negligence claims, providing peace of mind as you deliver your expertise to clients. Whether you’re a tech-savvy entrepreneur, a small business owner managing a team, or a professional providing specialized services, these additional insurance options can help you navigate potential risks with greater confidence.

Professional liability insurance: Safeguarding against professional negligence claims

Beyond the basics of commercial insurance, there are additional considerations that can provide tailored protection for your small business. Cyber liability insurance shields you against digital threats in today’s increasingly interconnected world. Employment practices liability insurance safeguards you from employee-related risks, including discrimination, harassment, and wrongful termination claims. Professional liability insurance, also known as errors and omissions insurance, protects you against claims of negligence or mistakes in your professional services. These additional policies offer a comprehensive safety net, ensuring you have the peace of mind to focus on growth and success.

Empowering Small Businesses: How Commercial Insurance Can Fuel Success

When venturing into the world of entrepreneurship, embracing the safety net of commercial insurance is paramount to safeguarding your small business’s potential for success. It’s like wearing a protective shield against potential financial pitfalls, allowing you to operate with confidence while mitigating risks and ensuring the longevity of your enterprise. Dive into the realm of tailored insurance policies, customized to fit your unique business needs. Explore cost-effective measures designed to minimize financial risks, ensuring your business remains resilient in the face of unexpected events. With commercial insurance as your ally, you gain an unwavering foundation to propel your business towards prosperity.

Peace of mind: Operating with confidence amidst uncertainties

Commercial insurance serves as a safety net for small businesses, providing peace of mind and financial stability to entrepreneurs like you. It’s like having a financial superhero on your side, ready to swoop in and save the day when unexpected events threaten your business. With tailored coverage that caters to your specific needs, you can rest assured that your assets, income, and reputation are protected. Think of it as a force field that shields you from the financial impact of accidents, lawsuits, and disasters. By investing in commercial insurance, you’re not only safeguarding your business; you’re also empowering it to thrive and grow. It’s the key to unlocking financial freedom, giving you the confidence to take calculated risks and pursue your entrepreneurial dreams without fear.

Financial stability: Preserving assets and ensuring growth

Commercial insurance is a cornerstone of financial stability for small businesses, paving the way for success. It acts as a safety net, shielding you from the unexpected financial pitfalls that can cripple your operations. With a tailored insurance plan in place, you can operate with peace of mind, knowing that your assets, income, and reputation are protected. Think of commercial insurance as a wise investment, an essential safeguard that empowers you to focus on what truly matters—growing your business and achieving your entrepreneurial dreams.

Enhanced reputation: Building trust and credibility with stakeholders

Commercial insurance is not a mere expense, but an investment in your business’s future success. By having the right coverage in place, you can operate with confidence, knowing that your assets and reputation are protected. Insurance acts as a safety net, shielding you from potential financial losses and providing peace of mind. It empowers you to take calculated risks, knowing that you have a financial cushion to fall back on. Embrace commercial insurance as a tool for growth, allowing you to focus on what truly matters – building a thriving business.

Q1. What is three small business insurance commercial?

Ans: Three small business insurance commercial is an adverting for insurance companies.

Q2. how to choos best three small business insurance commercial?

Ans: By reading commercials reviews, and compare coverage.

Q3. What is the most important things need to know before buy three small business insurance commercial?

Ans: Know your insurance needs, research the insurer’s reputation, and get quotes from multiple companies.

Q4. What is the benifit of three small business insurance commercial?

Ans: Protect business from financial risks, peace of mind, and improve reputation.

Q5. Which is the best three small business insurance commercial I can buy?

Ans: Top 5 Best Small business commercial Insurances.

Q6. How much most three small business insurance commercial company will cost?

Ans: The average cost of business insurance is between $500 and $1,500 per year, but It depends on the type of business, coverage, and location.