Navigating the intricate world of workers’ compensation insurance can be a daunting task. However, understanding the basics is crucial for safeguarding your employees and ensuring compliance. In this comprehensive guide, we will embark on a journey to decipher the intricacies of workers’ compensation insurance, empowering you with the knowledge to effectively obtain coverage and protect your workforce.As a business owner, it is your responsibility to prioritize the well-being of your employees. Workers’ compensation insurance serves as a safety net, providing financial relief and medical support to employees who sustain injuries or illnesses due to work-related activities. By delving into the eligibility criteria, coverage details, and application process, you will gain a profound understanding of this essential insurance and ensure a protected and secure work environment for your team.

Understanding the Basics: What is Workers’ Compensation Insurance?

Workers’ compensation insurance, a vital safeguard for you and your employees, provides financial protection in the unfortunate event of a work-related injury or illness. It ensures you can access the necessary medical care, rehabilitation, and income replacement benefits without facing financial ruin. By understanding the basics of workers’ compensation insurance, you can make informed decisions about coverage and ensure a secure workplace for everyone involved.

Eligibility Criteria: Who Qualifies for Workers’ Compensation Insurance?

Eligibility Criteria: Who Qualifies for Workers’ Compensation Insurance?

If you’re an employer, understanding who qualifies for workers’ compensation insurance is essential. This insurance provides crucial protection for your employees in the event of work-related injuries or illnesses. Generally, most employees are covered under workers’ compensation laws, regardless of their job title or industry. However, there may be specific exceptions or variations depending on your state’s regulations. To ensure compliance and protect your employees’ rights, it’s imperative to familiarize yourself with the eligibility criteria in your jurisdiction. By doing so, you can provide a safe and secure work environment for your team.

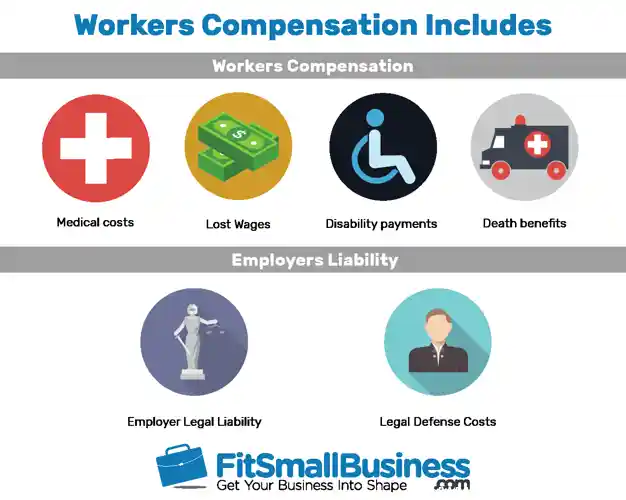

Coverage and Benefits: What Does Workers’ Compensation Insurance Cover?

Get ready to dive into the world of workers’ compensation insurance! In this section, we’ll explore the ins and outs of coverage and benefits. As an employer, understanding what’s covered under this policy is crucial. It ensures you’re adequately protected in the event of workplace accidents or illnesses. Stay tuned as we delve into the details of what workers’ compensation insurance covers, helping you make informed decisions for your business and employees’ well-being.

Obtaining Coverage: How to Apply for Workers’ Compensation Insurance

If you’ve been injured or become ill on the job, obtaining workers’ compensation insurance can be a crucial step in ensuring you receive the necessary medical care and financial support. Workers’ compensation insurance is designed to provide a safety net for employees who suffer work-related injuries or illnesses, protecting them from financial hardships and ensuring they have access to the resources they need to recover. Understanding how to apply for workers’ compensation insurance is essential for safeguarding your rights and accessing the benefits you’re entitled to.

Step-by-Step Guide to Applying for Workers’ Compensation Insurance

Applying for workers’ compensation insurance is like securing a safety net for your business. It’s crucial to know the ins and outs of the process to ensure you have the protection you need. Whether you’re a seasoned employer or just starting out, understanding how to obtain coverage will give you peace of mind. In this comprehensive guide, we’ll take you through the application process step by step, answering common questions and providing practical tips along the way. So, let’s dive right in and make sure your workforce is covered!

Navigating the Process: Common Questions and Challenges

Navigating the workers’ compensation insurance process can be like navigating a maze, filled with twists, turns, and potential pitfalls. Many common questions and challenges can arise along the way, leaving you feeling lost and overwhelmed. Fear not, for we’re here to guide you through the complexities of this essential insurance policy. Whether you’re an employer or an employee, understanding the intricacies of workers’ compensation can empower you to make informed decisions, protect your rights, and ensure a smooth claims process. Let’s embark on this journey together and unravel the mysteries of workers’ compensation insurance, leaving no stone unturned.

Q1. What are the benefits of workers compensation insurance?

Ans: Workers compensation insurance provides financial benefits to employees who are injured or become ill as a result of their job.

Q2. Who is required to have workers compensation insurance?

Ans: In most states, employers with a certain number of employees are required to have workers compensation insurance.

Q3. How much does workers compensation insurance cost?

Ans: The cost of workers compensation insurance varies depending on the size of the business, the industry, and the state in which the business is located.

Q4. How can I get workers compensation insurance?

Ans: You can get workers compensation insurance through a private insurance company or through a state-run program.

Q5. What are the penalties for not having workers compensation insurance?

Ans: The penalties for not having workers compensation insurance vary by state, but may include fines and imprisonment.

Q6. What should I do if I am injured on the job?

Ans: If you are injured on the job, you should report the injury to your employer and seek medical attention.