Navigating the complexities of workers’ compensation insurance can be a daunting task for both individuals and businesses. This comprehensive guide unravels the intricacies of workers’ compensation, empowering you with a profound understanding of its vital role in workplace protection. Whether you’re an employee seeking reassurance or an employer striving to optimize coverage, this guide will illuminate the essential components, eligibility requirements, claims procedures, and strategies for maximizing value. Together, we’ll decode the complexities of workers’ compensation, providing you with the knowledge and confidence to navigate this crucial aspect of workplace safety and financial security.

Decoding Workers’ Compensation: A Comprehensive Guide to Navigating the Process

Navigating the complexities of workers’ compensation can be daunting, but understanding the process is essential for protecting your rights and maximizing your benefits. This guide will provide you with a comprehensive roadmap to help you decode workers’ compensation, empowering you to navigate the process confidently. We’ll delve into the essential components of insurance coverage, empowering employees, navigating claims, and optimizing insurance value for businesses. So, let’s embark on this journey together and decipher the intricacies of workers’ compensation, ensuring you’re equipped to safeguard your well-being in the workplace.

Unveiling the Essential Components of Workers’ Compensation Insurance

Unveiling the essential components of workers’ compensation insurance is paramount to ensuring your business and employees are adequately protected. Understanding the coverage needs specific to your industry and workforce is crucial. From identifying potential hazards and assessing risks to determining the appropriate level of coverage, it’s essential to work with insurance experts to tailor a policy that meets your unique requirements. Additionally, comprehending the intricacies of premiums and deductibles empowers you to make informed decisions that balance coverage with affordability. By grasping these essential components, you unlock the ability to navigate the complexities of workers’ compensation insurance with confidence, ensuring compliance, protection, and peace of mind for your business.

Identifying Coverage Needs

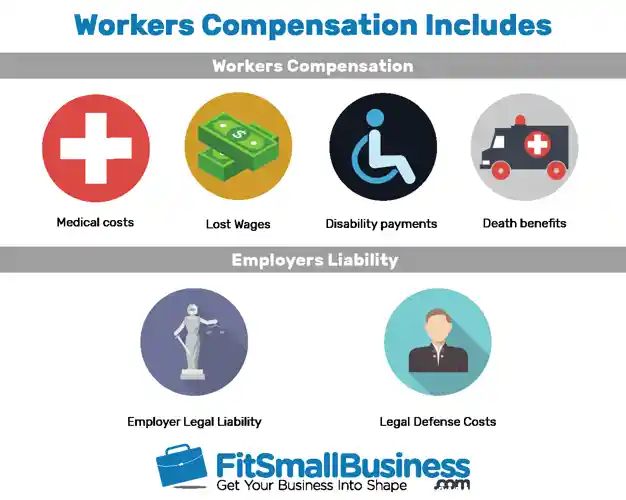

Understanding how to buy workers’ compensation insurance is crucial for safeguarding your business and employees. It’s like building a safety net that protects both parties in the event of a workplace accident or illness. This insurance not only provides medical coverage for injured employees but also covers lost wages, rehabilitation costs, and even death benefits. As a business owner, it’s essential to identify your coverage needs based on the nature of your industry, the number of employees, and the potential risks involved. It’s also important to understand the premium costs and deductibles associated with different policies. By carefully considering these factors, you can tailor an insurance plan that effectively protects your workforce and your business’s financial stability.

Understanding Premiums and Deductibles

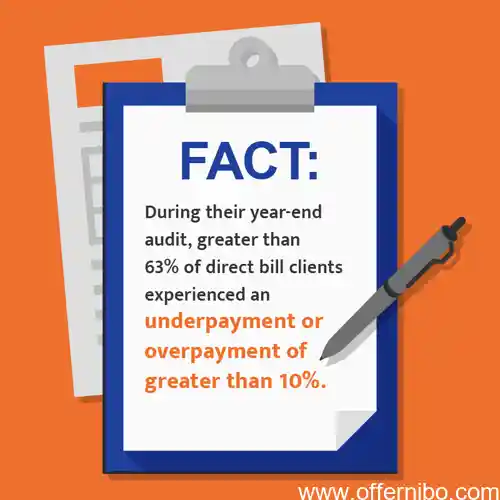

Navigating the intricate web of workers’ compensation insurance can be akin to walking through a maze, but understanding its essential components is the key to a successful journey. Identifying your specific coverage needs is paramount, as each business has unique risks and vulnerabilities. From hazardous workplaces and physically demanding jobs to administrative roles, the level of coverage required varies greatly. Premiums and deductibles are equally significant factors to consider. Premiums, typically paid annually, reflect the risk level associated with your business operations. Conversely, deductibles represent the amount you’re responsible for paying out-of-pocket before insurance coverage kicks in. Determining the appropriate balance between premiums and deductibles is crucial for optimizing your coverage and managing costs effectively.

Empowering Employees: The Significance of Workers’ Compensation for Workplace Protection

As an employee, understanding workers’ compensation insurance is paramount in safeguarding your well-being at work. This insurance provides a crucial safety net in the unfortunate event of an on-the-job injury or illness. It covers medical expenses, lost wages, and other benefits to ensure you receive the necessary support during your recovery. By empowering you with this protection, workers’ compensation insurance plays a vital role in creating a safe and secure work environment where you can focus on your responsibilities without worrying about the financial consequences of a workplace accident.

Navigating the Labyrinth of Workers’ Compensation Claims

Navigating the labyrinth of workers’ compensation claims can be a daunting task, but it doesn’t have to be. Understanding the process can help you ensure you receive the benefits you’re entitled to. Filing requirements, documentation guidelines, and dispute resolution processes vary by state, so it’s crucial to familiarize yourself with the specific laws and procedures in your area. Gathering all necessary documentation, such as medical records, witness statements, and accident reports, is essential for a strong claim. If a dispute arises, you may need to attend hearings or mediation sessions to resolve the issue. By staying organized, knowing your rights, and seeking professional guidance when needed, you can navigate the workers’ compensation claims process effectively and advocate for your well-being.

Filing Requirements

Navigating the labyrinth of workers’ compensation claims can be a daunting task, but understanding the process can empower you to protect your rights. Filing requirements vary by state, so it’s crucial to familiarize yourself with the specific procedures in your jurisdiction. Thorough and accurate documentation is key; keep a detailed record of your injury, medical treatment, and communication with insurers and employers. If a dispute should arise, documentation will serve as invaluable evidence. Remember, you have options to resolve conflicts; explore mediation or legal representation to ensure a fair outcome and secure the benefits you deserve.

Documentation Guidelines

Navigating the labyrinth of workers’ compensation claims can seem like a daunting task, but understanding the process and your rights as an employee can empower you to seek the benefits you deserve. Filing a claim involves adhering to specific requirements, such as reporting the injury promptly and providing necessary documentation. Knowing the guidelines for documentation ensures that your claim is supported by evidence. In cases where disputes arise, an understanding of the dispute resolution process will guide you through the steps to resolve the matter effectively. By familiarizing yourself with these aspects of workers’ compensation claims, you can confidently navigate the system and protect your rights in the event of a workplace injury.

Dispute Resolution

Filing workers’ compensation claims can be a daunting task, but it’s crucial to navigate the process efficiently. To ensure a smooth experience, gather all necessary documentation, such as medical records, witness statements, and accident reports. Timely filing is essential, so don’t hesitate to reach out to your employer or insurance provider for guidance. If you encounter any disputes, explore options like mediation or arbitration to resolve them amicably. By understanding the claims process and advocating for your rights, you can maximize the benefits you’re entitled to.

Maximizing Value: Optimizing Workers’ Compensation Insurance for Businesses

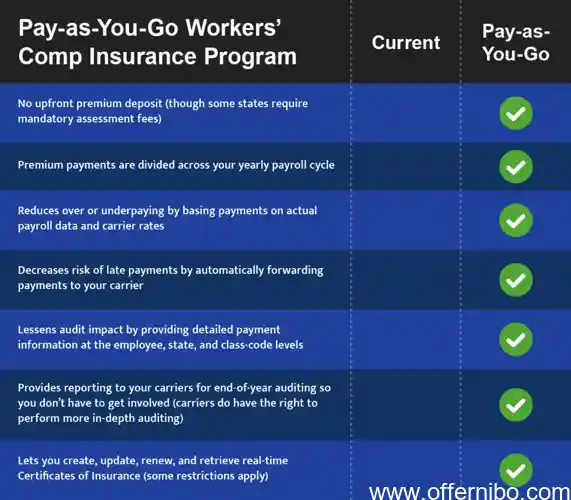

As a business owner, you’re well aware of the importance of protecting your employees and your business from the unexpected. Workers’ compensation insurance is a crucial part of that protection, providing a safety net for employees who suffer injuries or illnesses on the job. By optimizing your workers’ compensation insurance, you can not only fulfill your legal obligations but also maximize the value of this essential coverage. Let’s delve into how you can make the most of your workers’ compensation policy, ensuring both your employees’ well-being and your business’s financial stability. Consider your business’s unique risks, understand your coverage options, and implement strategies to minimize premiums and deductibles. A well-optimized workers’ compensation insurance plan not only safeguards your employees but also becomes a valuable asset for your business.

Risk Management Strategies

Unlocking the secrets to workers’ compensation insurance is crucial for businesses looking to protect themselves and their employees. Understanding the ins and outs of this complex system empowers you to make informed decisions that safeguard your workforce and optimize your bottom line. Let’s delve into the intricacies of workers’ compensation insurance, uncovering how to navigate the complexities and maximize its value for your business.

Cost-Saving Measures

When it comes to purchasing workers’ compensation insurance, it’s like buying a safety net for your business. You want to make sure it’s strong enough to catch any potential falls, but you also want to avoid paying more than necessary. By understanding your coverage needs, premiums, and deductibles, you can tailor your insurance policy to fit your specific requirements. This will help you protect your employees and your business from financial setbacks in case of an accident or injury. It’s like having a financial airbag that’s always there to cushion the blow when you need it most.

Q1. what is workers compensation insurance?

Ans: Workers’ compensation insurance provides wage replacement and medical benefits to employees who are injured or become ill as a result of their job.

Q2. Why do I need workers compensation insurance?

Ans: Workers’ compensation insurance is required by law in most states to protect businesses and their employees from financial losses due to work-related injuries or illnesses.

Q3. How much does workers compensation insurance cost?

Ans: The cost of workers’ compensation insurance varies depending on a number of factors, including the size of your business, the type of work your employees perform, and your claims history.

Q4. How do I get a workers compensation insurance policy?

Ans: You can purchase a workers’ compensation insurance policy through an insurance agent or broker.

Q5. What are the benefits of workers compensation insurance?

Ans: Workers’ compensation insurance provides a number of benefits, including wage replacement, medical benefits, and death benefits.

Q6. What are the penalties for not having workers compensation insurance?

Ans: Penalties for not having workers’ compensation insurance can vary depending on the state, but may include fines, jail time, and civil lawsuits.