Navigating the intricacies of health insurance for your small business can be a daunting task. As a business owner, providing health coverage for your employees is not just a responsibility, but an investment in their well-being and the overall success of your enterprise. Join us as we delve into the intricacies of small business health insurance, empowering you with the knowledge and insights to make informed decisions for your team’s health and financial well-being.In this comprehensive guide, we will guide you through the maze of health insurance options, helping you tailor coverage that meets your specific needs and budget. We will explore different plan types, including Health Maintenance Organizations (HMOs) and Preferred Provider Organizations (PPOs), so you can weigh their advantages and disadvantages. Understanding the dynamics of premiums and deductibles is crucial for optimizing your insurance costs, and we will provide you with expert advice on finding the right balance.Beyond insurance coverage, we will highlight the importance of accessing a comprehensive network of healthcare providers and specialists. We will discuss the role of referrals and how to ensure your employees have the support they need to receive timely and effective care. Furthermore, we will delve into the benefits that extend beyond insurance, such as wellness programs and resources, demonstrating how investing in your team’s well-being can enhance their productivity and loyalty.With this comprehensive guide, you will gain the expertise to navigate the complexities of small business health insurance with confidence. Empower yourself with the knowledge to make informed decisions, tailor coverage to your business’s unique needs, and foster a healthy, thriving workforce that drives your business success.

Navigating the Complexities: Understanding Small Business Health Insurance

Navigating the intricacies of health insurance can be a daunting task, especially for small business owners. Understanding how it works is crucial to making informed decisions that protect your team and your bottom line. Let’s delve into the complexities of small business health insurance and empower you with the knowledge to navigate this often-confusing landscape.

Tailoring Coverage to Your Business: Options for Small Employer Health Plans

When it comes to securing health insurance for your small business, understanding your coverage options is crucial. Just like selecting the right ingredients for a delicious recipe, choosing the best health plan for your team requires careful consideration. You’ll need to navigate the differences between Health Maintenance Organizations (HMOs) and Preferred Provider Organizations (PPOs). HMOs offer a more restricted network of providers but typically come with lower premiums. On the other hand, PPOs provide more flexibility in choosing healthcare professionals but may result in higher costs. Weighing these factors against your budget and your employees’ healthcare needs is essential to tailor a coverage plan that optimizes both affordability and access to quality care.

Weighing Health Maintenance Organizations (HMOs) vs. Preferred Provider Organizations (PPOs)

Navigating the complexities of small business health insurance can be like navigating a maze, but with the right guidance, you can find your way through. Understanding the different types of plans available, such as HMOs and PPOs, is key to finding the best fit for your business. HMOs typically offer lower premiums but may have a more limited network of providers. PPOs provide more flexibility in choosing providers but come with higher premiums. By weighing the benefits and drawbacks of each option, you can tailor your coverage to meet the specific needs of your team and your budget.

Navigating Premiums and Deductibles: Optimizing Your Health Coverage Costs

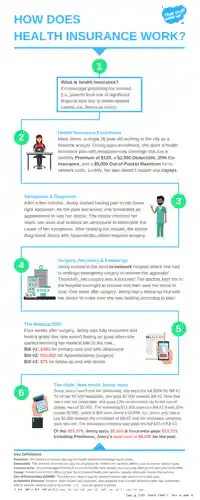

Navigating the complexities of small business health insurance can be as daunting as a maze. With premiums and deductibles being major components of your coverage costs, it’s crucial to optimize them. Understanding how these factors interplay can empower you to make informed decisions. Premiums are the regular payments you make to your insurer, akin to rent for your health coverage, while deductibles represent the amount you must pay out-of-pocket before your insurance kicks in. Think of it like the first layer of financial protection you shoulder before your insurance steps in. By understanding and adjusting these elements, you can tailor your plan to strike the right balance between affordability and comprehensive coverage. It’s like finding the sweet spot in a recipe, where each ingredient contributes to the overall flavor and nourishment.

Unlocking Access to Care: Networks, Providers, and Referrals

Navigating healthcare networks, providers, and referrals can be a labyrinthine maze for small businesses. Understanding how these components interlock is crucial to unlocking seamless access to care for your team. Health insurance networks are the gatekeepers to a vast array of healthcare providers. They establish contracts with hospitals, clinics, and individual practitioners, ensuring that your employees have access to a wide range of medical services. Within these networks, you’ll find different types of providers, each specializing in specific areas of medicine. Referrals, on the other hand, act as signposts, guiding patients to the most appropriate providers for their specific health concerns. By understanding these interconnected elements, you can empower your team to confidently navigate the healthcare landscape, ensuring they receive the right care, at the right time, and from the right providers.

Supporting Your Team’s Well-being: Benefits Beyond Insurance

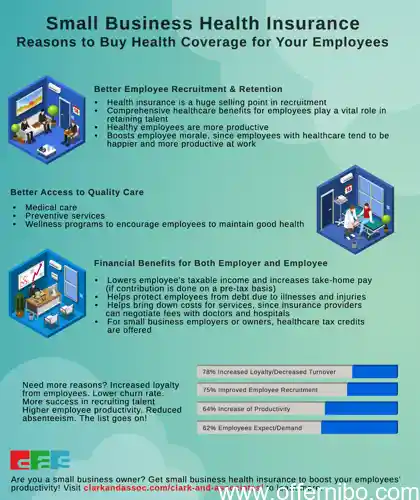

Supporting your team’s well-being extends far beyond providing health insurance coverage. By promoting wellness programs and resources, you can create a healthier and more productive work environment. Think of it as investing in your team’s overall well-being, leading to not only reduced healthcare costs but also increased employee morale and productivity. When your employees feel valued and supported in their health journey, they are more likely to stay committed and engaged in their work, fostering a positive and thriving work culture.

Promoting Wellness Programs and Resources

Beyond basic medical coverage, small business health insurance can extend its reach to encompass your team’s overall well-being. Embrace wellness programs and resources that prioritize preventive care, health education, and fitness initiatives. These proactive measures empower your employees to take charge of their health, reducing the likelihood of costly illnesses and fostering a culture of vitality. By investing in their well-being, you not only create a healthier workforce but also boost morale, enhance productivity, and curtail absenteeism. Embracing a comprehensive approach to health insurance is akin to nurturing the soil in which your business flourishes—a healthy team translates into a thriving enterprise.

Q1. How does small business health insurance work?

Ans: Small business health insurance plans provide coverage for employees and their dependents, typically through a network of providers.

Q2. What are the benefits of small business health insurance?

Ans: Benefits can include access to affordable healthcare, tax savings, and employee recruitment and retention.

Q3. What types of small business health insurance plans are available?

Ans: Options include group plans, individual plans, and association plans.

Q4. How much does small business health insurance cost?

Ans: Costs vary depending on factors such as the number of employees, the level of coverage, and the location of the business.

Q5. What are the requirements for small business health insurance?

Ans: Requirements include having a certain number of employees and meeting certain eligibility criteria.

Q6. How can I find the right small business health insurance plan?

Ans: You can compare plans from multiple insurers and consult with an insurance agent or broker.