Navigating the intricate maze of healthcare costs is a daunting task, particularly when it comes to understanding the delicate balance between insurance companies and hospitals. Rate negotiations, a crucial aspect of this healthcare landscape, play a pivotal role in determining the accessibility and affordability of medical services for you and millions of Americans. As an expert in the realm of healthcare finance, I embark on a journey to unravel the complexities of insurance-hospital rate negotiations. Join me as we delve into the strategies, factors, and challenges that shape these critical discussions, empowering you with the knowledge to navigate this intricate terrain.Throughout this comprehensive exploration, we’ll unveil the art of negotiation, deciphering the intricate strategies employed by both insurance companies and hospitals. We’ll dissect the key considerations and variables that influence rate determinations, providing you with a deeper understanding of the factors that impact your healthcare expenses. Furthermore, we’ll explore the decision-making processes, identifying the key players who participate in these negotiations and examining their roles and responsibilities.Notably, we’ll delve into the impact of market dynamics, shedding light on how external forces such as competition, regulation, and economic indicators influence the negotiation process. By understanding the interplay between these factors, you’ll gain valuable insights into the forces that shape the rates you pay for healthcare services. Finally, we’ll navigate the complexities of insurance-hospital rate negotiations, addressing the challenges they pose and exploring innovative solutions to overcome these obstacles. Together, we’ll empower you with the knowledge and understanding necessary to navigate this complex system, ensuring that you receive the healthcare you need at a cost you can afford.

The Intricate Interplay: How Insurance Companies and Hospitals Forge Rate Agreements

The intricate interplay between insurance companies and hospitals in forging rate agreements is a captivating dance of negotiation and strategy. Insurance companies, as the financial gatekeepers of healthcare, seek to secure rates that balance their solvency with ensuring accessibility to quality care. Hospitals, on the other hand, strive to establish rates that fairly compensate them for the services they provide while remaining competitive in the healthcare market. This delicate balance requires a deep understanding of the factors that shape these negotiations and the decision-makers who wield influence at the negotiating table. By delving into the nuances of this dynamic, you’ll gain insights into how insurance companies and hospitals navigate the complexities of rate determination, ensuring sustainable healthcare for all.

The Art of Negotiation: Unveiling the Strategies Behind Insurance-Hospital Interactions

Delving into the intricate dance of insurance companies and hospitals, we uncover the strategies that shape their rate negotiations. It’s like a delicate ballet, where each step is calculated and every move has the potential to impact the financial health of both parties. Hospitals, eager to secure fair compensation for their services, employ seasoned negotiators who know the art of leveraging their value. Insurance companies, driven by the need to manage costs, bring their own arsenal of strategies to the table. Understanding the dynamics of this negotiation is crucial for navigating the complexities of healthcare pricing and ensuring a balanced outcome that benefits both hospitals and patients.

Factors Shaping the Negotiations: A Comprehensive Analysis

Negotiating rates between insurance companies and hospitals is a complex dance, influenced by a myriad of factors that shape the ebb and flow of these interactions. It’s akin to a game of chess, where each move is carefully calculated, considering the strengths and weaknesses of both parties. Understanding these factors is crucial for navigating the complexities of insurance-hospital rate negotiations. It’s like having a map that guides you through the intricate terrain, helping you anticipate potential roadblocks and seize opportunities for mutually beneficial outcomes.

Unveiling the Key Considerations and Variables Impacting Rate Determinations

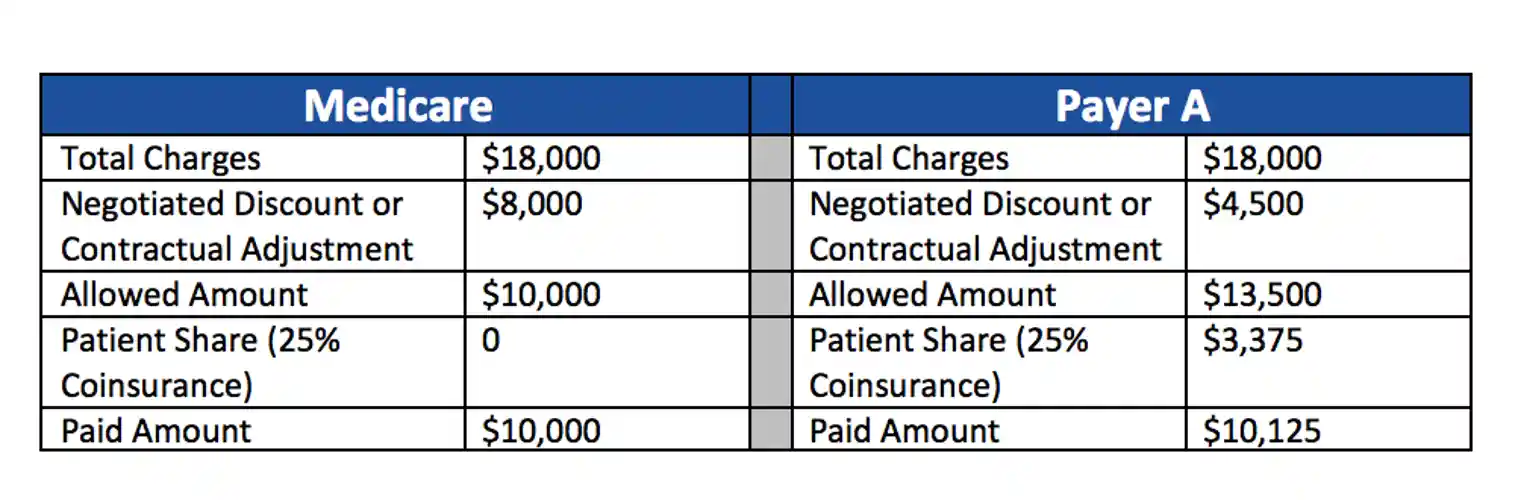

Negotiating rates between insurance companies and hospitals is a multifaceted dance, influenced by a myriad of factors. Imagine yourself as a master chef, carefully blending ingredients to create a symphony of flavors. In this case, the ingredients are the various considerations and variables that shape the outcome of these negotiations. These elements include the size and reputation of both parties, the specific services being negotiated, the competitive landscape, and the regulatory environment. Each ingredient has its own unique impact on the final agreement, with some holding more sway than others. By understanding and leveraging these factors, you can gain a strategic advantage in your own negotiations.

Delving into the Decision-Making Processes: Who’s at the Negotiating Table?

When it comes to negotiating rates between insurance companies and hospitals, a key element to consider is the individuals involved in the decision-making process. Picture a high-stakes game of chess, where each move can have a significant impact on the outcome. At the negotiating table, you’ll find a diverse cast of characters, each representing different perspectives and interests. Insurance companies typically send their top negotiators, armed with data and a deep understanding of the market. On the hospital side, administrators, financial experts, and even physicians play a crucial role, bringing their knowledge of patient care costs and local market dynamics to the table.

The Impact of Market Dynamics: How External Forces Influence Negotiations

The negotiation dance between insurance companies and hospitals is influenced by a myriad of external forces that sway the rhythm and tempo of their interactions. Market competition serves as a powerful choreographer, driving insurers and hospitals to strike a balance between securing favorable rates while maintaining their competitive edge. Regulatory measures, akin to the conductor of an orchestra, set the parameters and boundaries within which these negotiations unfold. Economic indicators, like the heartbeat of the market, provide the underlying rhythm that influences the pulse of these negotiations, affecting everything from reimbursement rates to the availability of healthcare services. Understanding the impact of these external forces is paramount in deciphering the intricate interplay between insurance companies and hospitals as they navigate the complexities of rate negotiations.

Understanding the Role of Competition, Regulation, and Economic Indicators

The impact of market dynamics on insurance-hospital rate negotiations cannot be understated. The competitive landscape, regulatory environment, and economic indicators all play crucial roles in shaping negotiations. Intense competition among insurance companies drives them to seek lower rates, while hospitals strive to maintain their profitability. Regulations imposed by government agencies can influence reimbursement policies and impact negotiations. Moreover, economic factors such as inflation, interest rates, and unemployment can affect both insurance premiums and hospital operating costs. Understanding these external forces and their potential impact on negotiations is essential for achieving favorable outcomes for both parties.

Navigating the Complexities: Challenges and Solutions in Insurance-Hospital Rate Negotiations

Navigating the intricacies of insurance-hospital rate negotiations can be akin to traversing a labyrinthine maze, fraught with challenges that demand astute problem-solving. Both parties embark on this negotiation with divergent objectives: hospitals seeking to maximize revenue and insurers striving to contain costs. Finding common ground often requires a delicate balancing act, where each party must make concessions while safeguarding their core interests. The path to successful negotiations is paved with effective communication, transparency, and a willingness to explore innovative solutions. It’s crucial to approach these negotiations with an open mind and a spirit of collaboration, recognizing that both parties share a common goal: ensuring accessible and affordable healthcare.

Q1. How do insurance companies negotiate rates with hospitals?

Ans: Insurance companies negotiate rates with hospitals through a process called contracting.

Q2. What factors do insurance companies consider when negotiating rates with hospitals?

Ans: Factors considered include the hospital’s costs, quality of care, and market competition.

Q3. How can hospitals improve their negotiating position with insurance companies?

Ans: Hospitals can improve their position by providing high-quality care, negotiating collectively, and understanding their costs.

Q4. What are the benefits of negotiating lower rates with hospitals?

Ans: Lower rates can reduce insurance premiums for consumers and businesses.

Q5. What are the challenges of negotiating rates with hospitals?

Ans: Challenges include the complexity of healthcare costs, the power imbalance between insurance companies and hospitals, and the need to maintain access to quality care.