Are you searching for the most competitive home and auto insurance quotes in Texas? Understanding the factors that influence these quotes is critical to securing coverage that meets your specific needs. In this comprehensive guide, we delve into the intricacies of Texas home and auto insurance quoting, equipping you with the knowledge to make informed decisions. We’ll explore the ins and outs of homeowner’s insurance, including the quoting factors that can impact your premiums. From property value to location and construction type, we’ll uncover the key elements that determine your coverage costs. Next, we’ll shed light on the variables that shape auto insurance quotes in Texas. We’ll examine how your vehicle’s demographics, such as make, model, and age, contribute to your premiums. By understanding these variables, you can optimize your coverage and save money. To help you navigate the complexities of insurance quotes, we’ll compare Texas home and auto insurance rates with those of other states. We’ll pinpoint the unique factors that differentiate Texas from the rest of the country, enabling you to make comparisons that lead to the right coverage for your needs. Finally, we’ll guide you through the steps to take after receiving home and auto insurance quotes. We’ll provide expert tips on how to evaluate quotes, negotiate with insurance providers, and maximize the value of your coverage. By following these strategies, you’ll be empowered to protect your home, vehicle, and finances with the most cost-effective insurance solutions available in Texas.

How to Secure Texas Home and Auto Insurance Quotes That Meet Your Needs

Securing Texas home and auto insurance quotes that align seamlessly with your unique needs is paramount for financial protection and peace of mind. With a plethora of insurance providers vying for your attention, it’s essential to equip yourself with the knowledge to make informed decisions. Understanding the factors that influence insurance premiums, such as your property’s location, construction materials, and claims history, is crucial in securing competitive quotes. Similarly, for auto insurance, your vehicle’s make, model, driving record, and usage patterns play a significant role in determining insurance costs. By delving into the nuances of home and auto insurance quoting in Texas, you’ll be empowered to navigate the complexities of the insurance landscape and secure coverage that meets your specific requirements.

Understanding Homeowner’s Insurance Quoting Factors in Texas

Securing the most suitable home and auto insurance quotes in Texas can be a daunting task, but it’s not an impossible one. By understanding the various factors that insurance companies consider when determining your rates, you can take proactive steps to improve your chances of securing the best deals. Let’s explore some key factors that influence your Texas home and auto insurance quotes, empowering you to make informed decisions and protect your assets effectively.

Unveiling Texas Auto Insurance Quoting Variables: A Comprehensive Overview

Unveiling Texas Auto Insurance Quoting Variables: A Comprehensive Overview

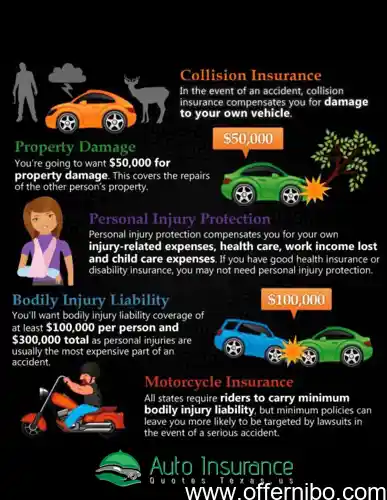

In the realm of insurance, understanding the factors that influence auto insurance quotes in Texas is crucial for securing the coverage that suits your needs and budget. Dive into the intricate world of Texas auto insurance quoting variables, where a tapestry of factors weaves together to determine your premium. From your vehicle’s age and safety features to your driving history and location, each thread contributes to the unique pricing equation. By unraveling these variables, you’ll gain a comprehensive understanding of how insurance companies assess risk and tailor quotes to your specific profile. Whether you’re a first-time driver navigating the insurance landscape or a seasoned policyholder seeking optimal coverage, this exploration will empower you to make informed decisions and secure the best “home and auto insurance quotes texas” for your journey ahead.

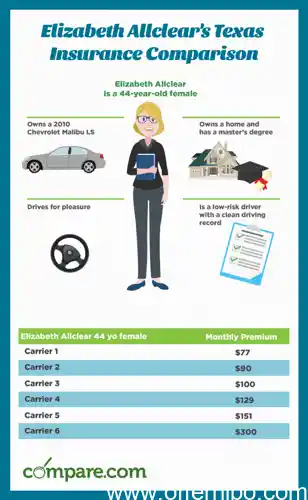

Cost Variations According to Vehicle Demographics

Unveiling the intricacies of Texas auto insurance quoting can be a labyrinthine journey. However, by understanding the variables that shape these quotes, you can navigate this maze with ease. Just as a compass guides you through unfamiliar terrain, a comprehensive overview of these factors will empower you to make informed decisions about your coverage and premiums. This in-depth exploration will shed light on how your vehicle’s age, driving history, annual mileage, and safety features influence the cost of your auto insurance. Additionally, we’ll delve into the impact of your location, zip code, and claims history on your insurance rates. By unraveling these complexities, you’ll gain the knowledge to secure Texas home and auto insurance quotes that align seamlessly with your unique needs and budget. So, buckle up and prepare to embark on this enlightening adventure into the world of Texas auto insurance quoting.

Why Texas Home and Auto Insurance Quotes Differ From State to State: A Comparative Analysis

Why do home and auto insurance quotes vary so drastically from state to state? The answer lies in a complex interplay of factors that shape the insurance landscape in each region. Understanding these variations is crucial for making informed decisions about your insurance coverage. Just like a tailor customizes a suit to your unique measurements, insurance companies tailor their quotes based on the specific risks and costs associated with your state. Factors such as population density, crime rates, natural disaster frequency, and legal regulations all contribute to the mosaic of insurance costs across the United States. Texas, with its vast expanse, diverse demographics, and unique weather patterns, presents a distinct set of challenges and opportunities for insurance companies. Delving into these intricacies will empower you to navigate the insurance market with confidence, ensuring that you secure coverage that aligns with your needs and budget.

How Insurance Companies Determine Texas Home and Auto Insurance Rates

Insurance companies carefully assess various factors to determine the rates for your Texas home and auto insurance. These factors influence the likelihood of claims and the potential severity of losses. For instance, your home’s construction materials, location, and proximity to fire hydrants affect your home insurance premiums. Similarly, your car’s make, model, safety features, and driving record impact your auto insurance costs. By understanding these factors and taking steps to mitigate risks, you can position yourself for more favorable rates.

What to Do After Receiving Texas Home and Auto Insurance Quotes: Maximizing Value

After you’ve compared numerous “home and auto insurance quotes Texas,” it’s time to take the next crucial step: analyzing and maximizing the value of the quotes you’ve obtained. Don’t rush into a decision; take your time to thoroughly evaluate each quote, considering factors such as coverage limits, deductibles, and premiums. Remember, the cheapest quote may not necessarily be the best one for you. It’s essential to find the right balance between cost and coverage that aligns with your specific needs and budget. Let’s delve into some practical tips to help you make the most of your insurance quotes and secure the optimal coverage for your valuable assets.