In today’s dynamic job market, education is paramount to career success. Recognizing the financial burden of pursuing higher education, the government has introduced the Education Tax Credit to assist you in offsetting the costs associated with qualifying educational expenses. However, understanding the eligibility requirements and intricacies of this valuable tax break can be a daunting task. This comprehensive guide will illuminate the qualifications, income limits, filing status, and dependents that impact your eligibility for the Education Tax Credit. We will also explore the types of expenses that qualify for the credit and provide guidance on optimizing your claim to maximize the tax savings you deserve. By demystifying the eligibility criteria and providing practical tips, this guide will empower you to confidently navigate the Education Tax Credit landscape and reap its financial benefits.

Can I Claim the Education Tax Credit? Unveiling Eligibility Requirements

Have you poured your heart and soul into your education, only to be met with the nagging question, “Why am I not getting the education tax credit?” Worry not! Unveiling the eligibility requirements for this credit is like navigating a maze, but I’m here to be your trusty guide. Let’s delve into the intricacies of income limits, filing status, and dependents to ensure you claim your rightful tax break. Stay tuned, as we uncover the secrets of education tax credits and empower you to maximize your savings!

Unlocking the Secrets: Understanding Income Limits for Education Tax Credits

Unlocking the Secrets: Understanding Income Limits for Education Tax Credits

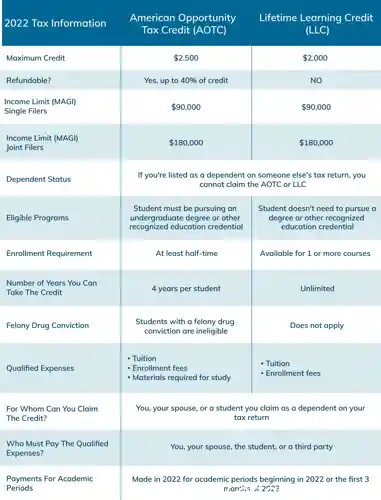

Why aren’t you receiving the education tax credit? One potential reason is that your income exceeds the established limits. Education tax credits, including the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit (LLC), are subject to income limitations. These limits ensure that the credits are targeted to those who need them most. For the AOTC, the full credit is available to single filers with modified adjusted gross income (MAGI) below $80,000 and married couples filing jointly with MAGI below $160,000. The LLC has higher income limits, with the full credit available to single filers with MAGI below $60,000 and married couples filing jointly with MAGI below $120,000. Understanding these income limits is crucial to determine your eligibility for these valuable tax credits. If your income falls outside of these limits, you may qualify for a reduced credit amount or may not be eligible at all. By examining your income and comparing it to the established limits, you can determine your potential eligibility for education tax credits and uncover any obstacles that may be preventing you from claiming them.

Navigating Education Tax Credit Eligibility: Filing Status, Dependents, and the Phase-Out

Navigating the intricacies of education tax credits can be a daunting task, especially when it comes to understanding how your filing status, dependents, and the phase-out mechanism affect your eligibility. Are you wondering why you may not be getting the full benefit of these tax breaks? Let’s delve into the complexities of these factors and uncover the nuances that can impact your eligibility, so you can maximize your tax savings.

Maximizing Your Education Tax Credits: Optimizing Expenses and Forms

Are you wondering why your education tax credit application isn’t reaping the rewards you expected? It could be a matter of optimizing your expenses and forms to maximize your claim. Let’s delve into the intricacies of maximizing your education tax credits and uncover the secrets to unlocking their full potential. Together, we’ll troubleshoot common obstacles and pave the way for a successful education tax credit journey.

Unveiling Qualified Education Expenses That Boost Your Credit

Have you ever wondered why you’re not receiving the education tax credit you thought you were eligible for? It’s time to explore the potential reasons behind this and find ways to maximize your tax savings. By optimizing your education expenses and ensuring you have the proper documentation, you can unlock the full potential of this valuable credit. Let’s dive into the details and uncover the secrets to maximizing your education tax benefits.

Troubleshooting Your Education Tax Credit: Common Obstacles and How to Overcome Them

Have you encountered difficulties claiming the education tax credit? Don’t fret! Many individuals face similar obstacles, and we’re here to help you navigate them. In this comprehensive guide, we’ll uncover common challenges and provide practical solutions to ensure you maximize your return. Whether you’re struggling to meet income requirements, understand eligibility criteria, or optimize expenses, we’ll empower you with the knowledge and strategies to successfully claim this valuable tax break. Get ready to delve into the world of education tax credits and overcome any hurdles that may stand in your way.

Q1. Why am I not getting education tax credit?

Ans: You may not meet the eligibility requirements, such as not being enrolled at least half-time, not taking eligible courses, or not meeting the income limits.

Q2. What are the income limits for the education tax credit?

Ans: The income limits vary depending on your filing status and the number of dependents you claim.

Q3. How do I claim the education tax credit?

Ans: You can claim the education tax credit by completing the IRS Form 8863, Education Credits.

Q4. What are some common reasons why people are denied the education tax credit?

Ans: Some common reasons include not meeting the eligibility requirements, making an error on the tax return, or not providing documentation to support the claim.

Q5. Can I get the education tax credit if I am not currently enrolled in school?

Ans: No, you must be currently enrolled at least half-time in a qualified educational institution to claim the education tax credit.

Q6. How long can I claim the education tax credit?

Ans: You can claim the education tax credit for up to four tax years.