Filing an insurance claim against another driver with GEICO can be a daunting task, but it’s crucial to protect your rights and ensure you receive fair compensation. Understanding the intricate claims process and navigating its complexities can be challenging. This comprehensive guide will empower you with the knowledge and strategies you need to navigate the maze of GEICO insurance claims successfully.As you embark on this journey, you’ll discover the step-by-step process of initiating and progressing your claim. From the initial contact with GEICO’s claims department to the final resolution, we’ll guide you through each phase, ensuring you grasp the intricacies and make informed decisions.Moreover, we’ll emphasize the significance of gathering irrefutable evidence to support your claim. This section will equip you with practical tips and advice on documenting the accident, obtaining witness statements, and preserving physical evidence. By building a solid case, you enhance your chances of maximizing your compensation.Additionally, we’ll delve into strategies for safeguarding your rights throughout the claims process. Understanding your legal entitlements and employing negotiation tactics will empower you to advocate effectively for a fair settlement.In cases where the situation becomes complex or a dispute arises, we’ll provide guidance on when and how to seek legal advice. Engaging an experienced attorney can help you navigate the complexities of the legal system and maximize your recovery.Whether you’re a seasoned insurance claimant or a first-timer, this extensive guide will serve as an invaluable resource, empowering you to navigate the GEICO claims process with confidence and achieve a favorable outcome.

Navigating the Maze of Geico Insurance Claims: Step-by-Step Guidance

Navigating the complexities of insurance claims can be a daunting task, especially when dealing with a reputable company like Geico. To help you navigate this maze successfully, we present a comprehensive guide that will empower you with the knowledge and strategies you need to effectively file and manage your insurance claim against Geico. Our step-by-step guidance will walk you through the entire process, from understanding the claims process to gathering evidence, protecting your rights, negotiating settlements, and seeking legal advice when necessary. By following our expert advice, you can increase your chances of obtaining a fair and satisfactory outcome.

Understanding the Claims Process: From Initial Contact to Resolution

Navigating the insurance claims process can be likened to navigating a labyrinth – filled with twists, turns, and potential roadblocks. But don’t let this deter you! By understanding the claims process, gathering evidence, and building a strong case, you can significantly increase your chances of a successful resolution. Remember, you’re not alone in this maze – you have the power to navigate its complexities and emerge with the compensation you deserve. Let’s embark on this journey together, step by step, and untangle the complexities of Geico insurance claims, empowering you to advocate for your rights and maximize your recovery.

Gathering Evidence and Building Your Case: Essential Steps for Success

When filing a claim against another driver’s GEICO insurance, gathering evidence and building a strong case is crucial for success. This involves documenting the accident scene, collecting witness statements, and obtaining medical records. Taking photos of the damage, capturing video footage if possible, and exchanging insurance information can help you build a solid foundation for your claim. Additionally, keeping a detailed record of all expenses related to the accident, such as medical bills and lost wages, will support your request for compensation.

Protecting Your Rights: Strategies for Maximizing Your Compensation

When you’re involved in an accident that wasn’t your fault, filing an insurance claim can feel like a daunting task. But don’t let the process overwhelm you. By taking the right steps and gathering the necessary evidence, you can protect your rights and maximize your compensation. Remember, you’re not alone in this. Insurance companies have a responsibility to treat you fairly and provide you with the coverage you deserve. So, don’t be afraid to stand up for yourself and fight for what you’re entitled to.

Negotiation and Settlement: The Art of Achieving a Fair Outcome

Negotiation and settlement can be a complex and challenging process, but it’s crucial for maximizing your compensation and achieving a fair outcome. Don’t let the insurance company take advantage of you. You have rights and options. It’s essential to approach negotiations with a clear understanding of your case, the evidence you’ve gathered, and your desired settlement amount. Be prepared to present your case effectively and negotiate assertively to ensure that your interests are protected. If you’re unsure about your rights or feel overwhelmed by the process, don’t hesitate to seek legal advice. An experienced attorney can guide you through the complexities of insurance claims and help you achieve the best possible outcome.

When to Seek Legal Advice: Navigating Complex Cases and Maximizing Recovery

Are you entangled in a complex car accident claim with Geico and feeling overwhelmed? It’s like navigating a labyrinth, where every turn seems to lead to a dead end. Don’t despair! Legal counsel can be your guiding light, helping you regain control and maximize your recovery. If your claim involves serious injuries, disputed liability, or an uncooperative insurance company, it’s time to seek professional advice. Lawyers possess the expertise to decipher complex legal jargon, negotiate with insurance adjusters, and fight for your fair compensation. Don’t hesitate to reach out for legal assistance when you need it most – it could make all the difference in securing the justice you deserve.

Q1. How do I file an insurance claim against another driver with Geico?

Ans: You can file a claim online, over the phone, or through the Geico mobile app.

Q2. What information do I need to file a claim?

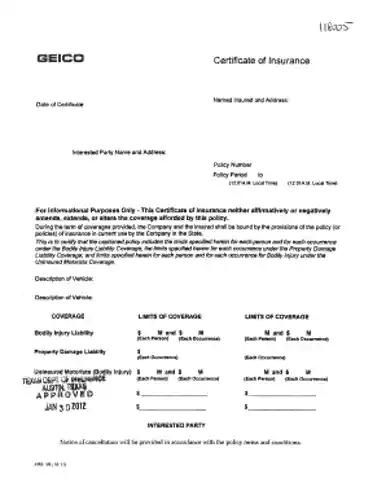

Ans: You will need the policy number of the other driver, the date and location of the accident, and a description of the damage.

Q3. What happens after I file a claim?

Ans: Geico will investigate the claim and determine if you are eligible for compensation.

Q4. How long does it take to process a claim?

Ans: The time it takes to process a claim can vary depending on the complexity of the case.

Q5. What if I disagree with Geico’s decision?

Ans: You have the right to appeal Geico’s decision if you believe it is incorrect.

Q6. Can I get a rental car while my car is being repaired?

Ans: Geico may offer a rental car if your car is not drivable due to the accident.